Mysteel:2024 Chinese welding steel pipe production panoramic insight

Overview:In 2024, the steel industry still faces various pressures and challenges from international and domestic: the international geopolitical conflict has intensified, the Federal Reserve has repeatedly delayed interest rate cuts, the domestic real estate industry continues to shrink, and the contradiction between supply and demand of the steel industry is prominent. Essence Especially as one of the important construction steels, its demand and dosage are obviously dragged down by the decline in the real estate industry. The efficiency deviation of the welding steel pipe industry has been superimposed this year, the adjustment of manufacturer's operating strategy, and the structural changes in the matching of downstream steel. The overall 2024 year in the first half of 2024 The output of welding steel pipes nationwide showed a year -on -year decline.

1. Price focus movement down

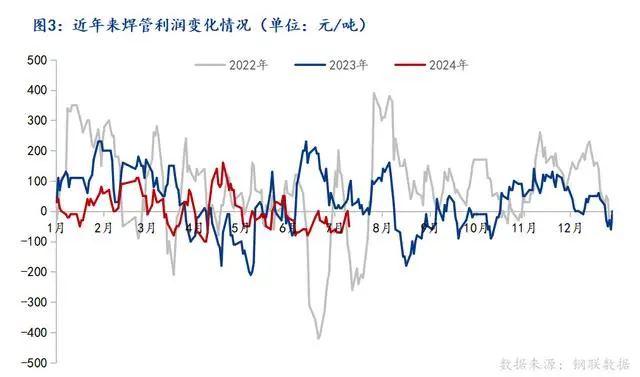

In terms of price, the national welded pipe prices in 2024 showed a step -level decline. As of July 9, the average national welded pipe price was 4167.65 yuan/ton (4*3.75mm, the same below), a year -on -year decrease of 255.6 yuan/ton. Regardless of whether it is because of the passive decline of the variety supply and demand mismatch or the active price reduction of manufacturers at the price exchanges, the further downward movement of the price of welding pipes will not be a favorable condition for the increase in the output of welded pipes across the country.

2. Domestic welded pipe production capacity and output changes

Total production capacity

According to the statistics of MySteel's full samples, the total production capacity of my country's welding steel pipes in 2023 was 115.97 million tons. In 2024, the product line and welded pipe head production enterprises were expanded in the long process steel plant. The annual new welded pipe production capacity is about 3 million tons, and the elimination capacity is removed. In 2024, the total capacity of my country's welded pipes is expected to reach 118 million tons.

Total output

Although the active layout of some leading enterprises in some welded pipes increases production capacity, its own production capacity utilization rate has not improved or even declined significantly. The operation of small and medium -sized enterprises is difficult to operate. After the Spring Festival resumption of work, it has been at a low level. As of July 5th, the MYSTEEL survey data shows that the total output of the 29 mainstream domestic sample pipes was 8.408 million tons, which was reduced by 12.57%compared with the output of 9.6172 million tons in the same period last year. Especially from the data of the end of June and early July, the output of the welded pipeline of the sample enterprise pipe factory is around 32-33 million tons, and the pipeline output situation of the pipe factory during the May 1st holiday has set a new low level after the Spring Festival.

Segmentation of species yield

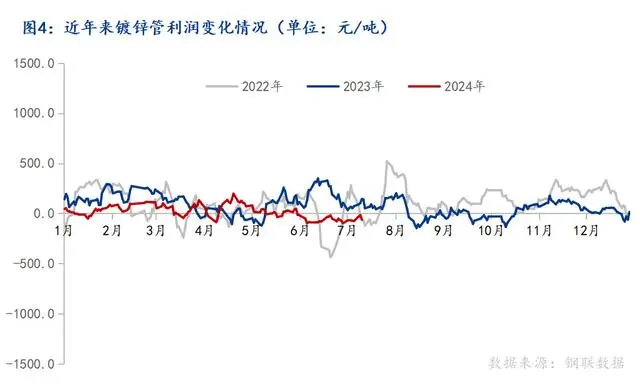

As of July 5, the survey data showed that the total output of direct welding tubes in the 29 mainstream domestic sample management plants was 8.408 million tons, a year -on -year decrease of 12.57%, and the total output of galvanized pipes was 6.355 million tons, a year -on -year decrease of 13.12%.

In addition, since 2023, the yield of the variety of species has also followed the proportion of the decline in the proportion of the decline. The decline in welded pipes is relatively obvious; the proportion of high value -added products has increased significantly. Among them, the proportion of welding pipes in the galvanized circular tube increased from 44.5%in 2022 to 51.7%. The output of scaffolding and plate scaffolding is greatly affected by real estate downturn.

表1:2022-2023年细分品种产量变化情况(单位:万吨)

In the short term, the competitive pressure of the steel pipe industry is still severe, and the survival space of the small pipe factory continues to compress the survival space of the small pipe factory in the context of the supply of excess. Various uncertainty.

However, in the context of active fiscal policies and loose monetary policies in China, with the acceleration of local debt issuance, the demand for use of pipes after the implementation of the project funds will be promoted. It will be further accelerated, the steel structure and infrastructure field transformation, guardrails, water conservancy, power, oil and gas pipelines, thermal power and other fields will still be available. On the whole, the demand will occur in the second half of 2024, but structural changes will still occur in different varieties of steel pipes. The square tube may be stronger than the straight seam welding tube, and the infrastructure tube is better than the real estate pipe.

If the total output of the welded pipes in the second half of the year and even the whole year is roughly estimated, according to previous years of experience, because in the first and second quarters, the production capacity was often lower than the third and fourth quarters due to the Spring Festival and May Day holidays. The supply of welded pipes or a small increase in the semi -annual increase. The total output of welded pipes throughout the year was about 60 million tons, a decrease of 2.77%year -on -year, and the average capacity utilization rate was about 50.54%, a decrease of 2.75%year -on -year.